In the ceaseless search for alpha, global investors are taking notice of many trends in China, but two of the most important are that the earnings for A-share companies is strong and expected to remain so, and that valuations of A-shares are now more in line with offshore Chinese equities. For a glimpse at what is driving these trends, II spoke to Richard Gao, Portfolio Manager and Research Principal, China, Matthews Asia.

How has the inclusion of China A-shares in MSCI’s emerging market indices played out for foreign investors so far?

Richard Gao: Right now, we are very excited about the A-share market in terms of the valuation. It is trading at a very attractive PE ratio compared to its historical average. Historically the A-shares are known for their volatility and high valuations. Interestingly, Chinese companies listed offshore had been trading at a much cheaper valuations because the A-share market is dominated by retail investors, and retail investor behavior tends to be more speculative, news-driven, and short-term oriented. Historically, that’s why volatility and valuations were high.

How is increased participation by institutional investors affecting the investment culture in China?

Gao: The valuation gap between onshore and offshore Chinese companies has started to narrow over the past two years because investors are becoming more mature and influenced by the growing participation of institutional investors – especially foreign institutional investors. At the current level, we can see that China A-shares are trading at similar valuations compared to offshore equities without much premium. I’ve been following the A-share market for more than a decade, and there were very few times when I’ve seen A-shares trading at such low valuations – and with no premium over the offshore listed equities. This is really an interesting time to look more into the A-share market.

Specifically, regarding foreign institutional investors, what has been the effect of their participation in A-shares?

Gao: Foreign institutions’ participation in the A-share market has increased quite substantially. Over the past three years, the foreign ownership of A-shares increased from less than 1% to close to 3% now. We expect this trend to continue in the coming years, and the growing participation of the foreign institutional investors to have positive impact on the investment culture and investors’ behavior in China by shifting the focus to the long-term fundamentals of companies – a more rational approach. At Matthews Asia, we are very excited to see this trend happening because it is right in line with our long-term fundamental approach when it comes to picking stocks.

Does passive participation in the index necessarily access the best opportunities in China?

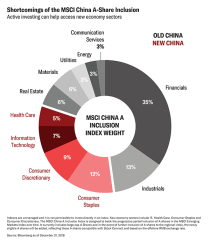

Gao: Most participation in A-shares from foreign institutional investors is passive investment –they pretty much follow MSCI’s guidance. But if we take a close at China A-share inclusion in the index, you’ll see that the components are quite concentrated in areas such as financials and industrials. There is much less exposure in the new economic sectors – health care, information technology, consumer discretionary, and consumer staples combined only account for about 33% of the index. We don’t believe this to be a very good representation of investment opportunities in China, especially in the newer and more dynamic areas of the economy. Of course, MSCI has its own selection criteria, which includes market capitalization and liquidity, but we believe that our active investment approach will lead to more growth opportunities among much smaller companies within the domestic consumption and services sectors, for example. And we think that will drive China’s future growth.