After a slowdown in issuance that mirrored public markets during the first month of the global pandemic, investment grade private credit markets sprang back to life in late April and May. Investors were able to source attractive deals at significant yield premiums to similarly rated public bonds. Additionally, active managers continue to exploit market dislocations and generate strong risk-adjusted returns for clients by adding high-quality assets at historically compelling spread levels.

SLC Management believes there is a long-term role for both public and private fixed income in investors’ portfolios. Investment grade private credit complements public credit by adding additional spread premium and diversification while retaining a high correlation to long-term financial liabilities.

What is investment grade private credit?

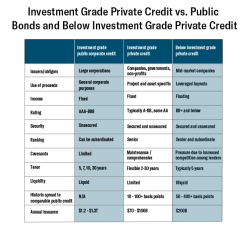

Investment grade private credit¹ refers to loans and debt securities issued by companies or entities outside of the public capital markets. Investors are primarily institutions such as insurance companies and pension funds.

- Investment grade private credit instruments are similar to public debt. They typically have durations that range from five to 30 years, often include collateral and financial covenants, and are available across the rating spectrum.

- Investors are paid a spread premium over comparable public bonds because these transactions are more customized and less liquid.

- The private placement issuer base includes public and private corporate issuers and spans major sectors (industrials, utilities, financials).

- Annual issuance in the investment grade private credit market is $70 to $100 billion and growing, with the U.S. representing about 60% of annual volume.

Why investment grade private credit?

The strength, durability, and growth of the investment grade private credit market reflects the wide range of benefits afforded to both issuers and investors.

Benefits to borrowers of investment grade private credit issuance

Flexible terms: Features and deal terms of investment grade private credit can be highly customized to meet the needs of the issuer and include non-standard maturities, delayed or multiple draw periods and custom amortization.

Confidentiality: Issuers of investment grade private credit can bypass the time and expense associated with public disclosure and registration requirements, allowing private issuers to maintain confidentiality.

Knowledgeable investor base: Most investment grade private credit investors are affiliated with larger investment management organizations with dedicated analysts capable of underwriting unique or complex transactions that would be difficult to execute in the public market. Issuers also value the ongoing relationship with private investors as a source both of capital for growth and structuring expertise.

Benefits to investors of investment grade private credit markets

Diversification: The investment grade private credit market offers investors the opportunity to invest in unique transactions and issuers not available to public bond investors.

Higher spreads: A combination of the illiquidity premium and bespoke nature of investment grade private credit placements relative to public bonds allow investors to capture a spread premium over comparable public issuers, as well as the potential for additional income associated with consents, amendments and, in some cases, coupon increases.

Better lender protections: Investment grade private credit investors benefit from deal structures that are typically more robust than public market transactions, including collateral and financial covenants that allow investors to get back to the negotiating table in the event of credit deterioration. Investors also benefit from direct access to management along with access to information not available to public investors.

Applications for insurance companies

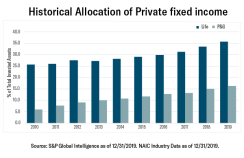

The attractive capital efficient yields have made investment grade private credit an integral component of life insurer’s portfolios, and in recent years, there has been significant adoption within the Property and Casualty (P&C) segment as well. P&C insurers look for ways to add yield without taking on additional credit risk or exposing themselves to regulatory charges, and investment grade private credit can effectively deliver these characteristics to the portfolio.

Capital framework treatment

Investment grade private credit is typically treated like any other fixed rate corporate debt security from an accounting and capital perspective. On a capital-adjusted basis, investment grade private credit presents insurers the opportunity to add attractive yield to their portfolios at a similar capital charge to traditional public debt.

Statutory and regulatory treatment

From a statutory filing perspective, investment grade private credit is disclosed on Schedule D Part 1 (Bonds) as an Amortized instrument, in line with traditional public debt. Similarly, the Risk Based Capital charges for investment grade private credit correspond to a NAIC 1 – 2 bond, depending on the rating.

Regulatory modeling (AM Best BCAR, Moody’s, S&P)

About 80% of investment grade private credit deals have nationally recognized statistical rating organization (NRSRO) ratings, and the remaining balance is filed directly with the securities valuation office (SVO). In most cases, ratings agencies do not penalize investment grade private credit relative to traditional public fixed income. BCAR, Moody’s and S&P all treat investment grade private credit similarly to other fixed income securities that have a corresponding rating. However, Moody’s and S&P may apply a minor liquidity premium if they feel investment grade private credit allocations are excessive.

SLC Management works with clients and consultants to manage liquidity concerns around private assets. Our investment process for insurers begins with a full review by our insurance solutions team. Stochastic modeling highlights areas of operational stress (reinsurance limits, CAT risk, and premium collection rates), measures the required portfolio liquidity and then assesses a client’s ability to harvest the illiquidity premiums available in private assets within a portion of their portfolio.