Investment-grade government and credit bonds, often weighted toward the long end, largely persist as the primary hedging assets in most liability driven investment (LDI) strategies.

The Bloomberg Barclays U.S. Long Government/Credit (LGC) Index owes its lasting strategic relevance to its constituent bonds, which collectively remain widely recognized as the universe of basic hedging assets available to liability-minded DB plan sponsors. Therefore, the index is useful for building a map that illustrates the core LDI opportunity set. Understanding the composition of this universe of long bonds is crucial for plan sponsors seeking to craft an effective investment strategy. Here, Colyar Pridgen, Senior LDI Strategist, Capital Group, lays out the opportunity set in LDI, along with related insights from the firm’s LDI approach.

The long bond market is relatively small and nuanced

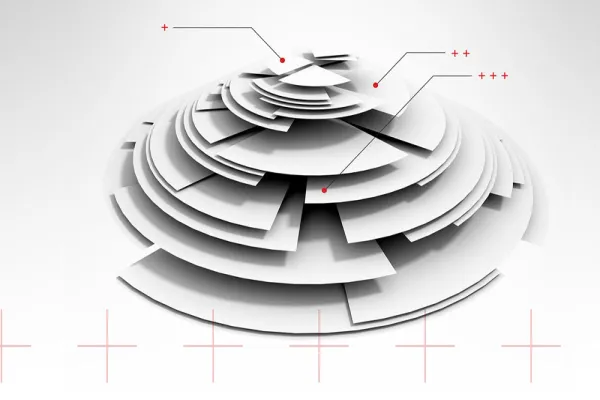

The long bond market makes up a rather limited portion of the broader fixed income universe. Using the Bloomberg Barclays U.S. Universal Index1 as an imperfect proxy for the full dollar-denominated bond market, the map below demonstrates that the long end (bonds with maturities of at least 10 years) is much smaller than the intermediate space (maturities of 1 to 10 years).2

Many corporate DB sponsors, insurers and other investors are seeking returns and hedging opportunities in the long bond market, leading to a diversity of approaches toward pursuing long bond exposure. In some cases, these investors are searching for more creative and less traditional avenues toward accessing long duration. Some of these are captured by the U.S. Universal Index, though high-yield debt and other instruments within that index can stray from what many sponsors consider to be core hedging assets.

That brings us to the map below, our main map of the long bond market, which essentially unpacks the bottom right corner of the chart on the previous page. The constituents of the LGC index, depicted below, represent the foundational toolkit of physical bonds that U.S. corporate DB plans most frequently use to implement LDI strategies.

One key takeaway from this map is that the AA-quality segment of corporate bonds in the long end of the market is rather small.3 While discount rate selection methodologies vary somewhat, these long AA corporate bonds typically drive the critical tail ends of the discount curves used for valuing pension liabilities for accounting purposes. Despite this important role in liability measurement, it’s clear that prudent investors must broaden their investments beyond AA-rated bonds, simply due to their limited depth and breadth.

The long bond market is far from static.

Another fundamental observation is that many of the indices and subindices that have gained prominence in LDI benchmarking – often at the expense of the LGC index’s popularity as a benchmark – are actually subsets of the Long Government/Credit index. The composition of these various groupings, and their relative stature within the broader long bond ecosystem, are far from static. As the market value of the LGC index has increased, the proportions of the underlying components have changed over time, as shown in the chart below.

Changing patterns of credit issuance are a key driver of the shifts seen above. Growth in the size of the Bloomberg Barclays U.S. Long Credit Index (the LC index) and drift in its quality distribution, are other closely related outcomes. Of particular importance in an LDI context, ratings migration tends to impact assets and liabilities quite differently. The widely observed trend toward lower quality in recent years is evident in the chart below.

The “History of U.S. Long Government/Credit Index by Sector” and the “History of U.S. Long Credit Index by Quality” charts illustrate some of the key dynamics at play in the long bond market, while the “U.S. Universal Index” map presents the long end in a broader fixed income context. At Capital Group, we believe the “U.S. Long Government/Credit Index” map – the main map of the long bond market – provides critical detail for setting effective pension investment strategy, and offer here an example of how it might be used to facilitate the LDI benchmark selection process.

Using the long bond market map for LDI benchmark selection and customization.

Benchmarking in an LDI context can be a dizzying topic. Differing plan circumstances and sponsor preferences have driven a proliferation of benchmarking philosophies. However, sponsors are in many cases using similar fixed income building blocks to craft these varied benchmarks and, explicitly or otherwise, often expressing answers to certain universal questions via their benchmark selection. We believe that a map of the long bond market, such as the Map of U.S. Long Government/Credit Index above, can facilitate a productive benchmarking, can facilitate a productive benchmarking dialogue and ultimately enhance decision-making with respect to important questions such as:

Basic component selection/weighting

- Is the Bloomberg Barclays U.S. Long Government/Credit Index the best benchmark for my plan? Do I instead want to more explicitly define the mix of credit and government components, given my broader asset allocation?

- Is corporate or credit a more suitable basis for the credit-risky portion of my benchmark? Is Treasury or government a more suitable basis for the credit-riskless portion of my hedging portfolio? Do I view these as material decisions?

- Could more nuanced benchmark construction (e.g., issuer caps, quality restrictions, maturity bucketing, sector reweighting) offer improvements in liability matching or other investment goals?

- Should pension risk transfer objectives influence these benchmark engineering decisions? Is transfer-in-kind feasible?

- Should bonds outside of the long government/credit universe, such as intermediate maturity, high yield and private debt, play a role within my hedging portfolio?

- Should STRIPS (or derivatives such as U.S. Treasury futures or interest rate swaps) be leveraged in enhancing capital efficiency and/or matching liability-relative curve risk?

- Do I want an investment strategy that is managed or measured more explicitly against my liability? How do I ensure manager accountability and proper governance? Does completion management offer a practical solution?

Exhibit 1: Map of U.S. Universal Index “Long STRIPS” refers to U.S. Treasury STRIPS with maturities of at least 10 years, which are not part of the LGC index. While depicted as a subset of long Treasury in order to offer a broad sense of the relative size of an important component of the universe of physical hedging instruments (and to avoid potentially double-counting stripped Treasuries), note that STRIPS are not in fact a component or subset of Treasuries. Note also that because Long STRIPS contain no cash flows before 10 years (while long Treasury, on the other hand, does implicitly incorporate shorter-dated cash flows in the form of coupon payments), there is some measure of inconsistency worth noting (e.g., arguably, technically nine-year coupon STRIPS could be included here, to the extent that they are created from coupons of Long Treasuries).

Exhibit 2: Map of U.S. Long Government/Credit Index “Sovereign, etc.” refers to the aggregated-for-convenience sectors of sovereign (the largest sector included herein), foreign agencies (which have similar quality distribution though skewed somewhat higher), and supranational (a relatively small sector which in the long end is entirely AAA-rated bonds). The other noncorporate credit sector, shown distinctly, is described as “local authorities,” which is technically the Class 2 description for the foreign local governments sector.

Exhibit 3: History of U.S. Long Government/Credit Index by sector Before 6/30/2000, many credits that today would be categorized as long corporate were instead a component of the long noncorporate credit universe, with the legacy sector name foreign corporations. These securities have been included in the “Sovereign, etc.” category for periods prior to 6/30/2000.

Exhibit 4: History of U.S. Long Credit Index by quality Before 6/30/2000, many credits that today would be categorized in the foreign local governments sector (which we call “local authorities”) were instead identified by the legacy sector name Canadian. These securities have been included under “local authorities” in our historic figures.

1 Per Barclays POINT: “The U.S. Universal Index represents the union of the U.S. Aggregate Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the Emerging Markets Index, and the non-ERISA portion of the CMBS Index. Municipal debt, private placements, and non-dollar denominated issues are excluded from the Universal Index. The only constituent of the index that includes floating-rate debt is the Emerging Markets Index.” POINT is a registered trademark of Barclays Capital Inc.While quite broad, the more than $25 trillion U.S. Universal Index offers an admittedly incomplete representation of the dollar-denominated bond universe; and in addition to the exclusions noted by Bloomberg Barclays, it is notable that securities with maturities of less than one year are omitted. For the purposes of this article, the U.S. Universal Index is considered to be sufficiently broad, and to capture the bulk of bonds important to most liability driven investors.

2 This is especially true on a market value basis. Note that all figures and charts in this article are presented in market value terms.

3 The AA segment of the long corporate index is also quite concentrated, with four issuers accounting for significantly more than 50% of its market value as of 3/31/2019. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Disclosures

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

The return of principal for bond portfolios and for portfolios with significant underlying bond holdings is not guaranteed. Investments are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Barclays POINT data ©2019 Barclays Capital Inc. Used with permission. POINT is a registered trademark of Barclays Capital Inc.

Past performance is not indicative of future results.

All Capital Group trademarks referenced are registered trademarks owned by The Capital Group Companies, Inc. or an affiliated company. All other company and product names mentioned are the trademarks or registered trademarks of their respective companies.

American Funds Distributors, Inc., member FINRA.