During the worst of the market turmoil in February and March 2020, fixed income ETFs became central to the investment decision-making process for a growing number of institutional investors. Given the lack of liquidity and price discovery in the underlying markets, portfolio managers and traders used fixed income ETFs to understand rapidly changing market conditions; help price individual bonds and portfolios; determine absolute and relative value opportunities that underpin allocation decisions; implement decisions rapidly and efficiently; and hedge unwanted risk. Here are two examples that highlight why and how institutional investors pivoted to fixed income ETFs during the extraordinary market volatility, and how fixed income ETFs are like a technology that can potentially offer flexibility, lower trading costs and the convenience of market access.

Use case #1: Liquidity management

Buyer: An asset manager elects to use high yield fixed income ETFs for the first time.

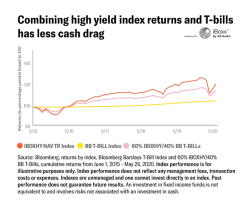

Background: Asset managers need liquidity to manage fund subscriptions and redemptions while remaining invested to avoid cash “drag” that can lead to underperformance relative to their benchmark. The certainty of execution matters most in assets such as high yield bonds, where transacting in individual securities can be time-consuming and expensive.

Challenge: During March 2020, extreme volatility diminished liquidity in the high yield market. Fund portfolio managers struggled to sell bonds to raise cash to meet redemption requests. At the same time, as market sentiment turned positive, it was hard to buy enough high yield bonds to keep pace with the rally.

Traditional approach: Traditionally, high yield bond fund portfolio managers created liquidity tiers, or “sleeves,” using the most liquid securities within a given asset class and cash-like instruments including money market funds.

Fixed income ETF approach: Needing to take quick action in the context of market volatility, one large asset manager purchased $250 million of HYG. It was the first time the manager had used a fixed income ETF and did so for liquidity, speed and efficiency. By using HYG in their liquidity sleeve instead of high yield bonds, this asset manager was seeking to access both yield and market beta while maintaining the ability to liquidate, if necessary.

Use case #2: Strategic Asset Allocation

Buyer: An insurer puts investment grade corporate fixed income ETFs at the center of their portfolio.

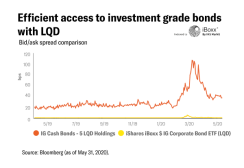

Background: Life insurers deal with significant premium cash flows every day. Their businesses depend on quickly and efficiently investing such cash flows to meet their liability obligations.

Challenge: Finding individual investment grade bonds was difficult because liquidity and new issuance dried up in February and March 2020. During this time, bid/ask spreads for investment grade bonds widened from about 25bps to over 100bps, in price terms, while LQD’s bid/ask spread stayed below 2bps over the same period.7

Traditional approach: Traditionally, insurers relied heavily on individual investment grade bonds for liability matching, often by investing in newly issued bonds, which tend to be highly liquid.

Fixed income ETF approach: One major U.S. insurer was faced with the prospect of holding too much cash and earning too little income. To help remedy this mismatch, the insurer invested in the highly liquid LQD.

Use case #3: Tactical Asset Allocation

Buyer: A large public pension plan targeted emerging market fixed income ETFs in rapidly changing conditions.

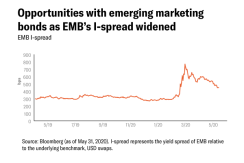

Background: Public pensions must maintain diversified portfolios that can meet the income obligations of their beneficiaries. Pension managers must rapidly and efficiently adjust investment exposures in changing market conditions.

Challenge: Price dislocations in March 2020 across the fixed income markets presented opportunities to many investors in areas including emerging markets.

Traditional approach: Pension funds purchased large, liquid individual bonds or employed derivative products such as CDX in order to build desired exposure.

Fixed income ETF approach: The plan sought to rebalance its portfolio to include higher-yield seeking assets including emerging market debt, hoping to take advantage of the broad sell-off. But it was expensive and time-consuming to build this position using individual bonds, given the sharp widening in bid/ask spreads for these securities. Dislocations in the basis between physical bonds and CDX made a derivative solution less palatable as well.

In this use case, the plan opted to express its tactical market view using the iShares JP Morgan USD Emerging Markets Bond ETF (EMB), which has traded nearly $600 million on an average day.8 By using EMB, the plan could quickly access the desired asset class while limiting transaction costs to single-digit bid/ask spreads versus several percentage points for comparable bonds. Liquidity was also a consideration as the ETF would allow them to efficiently increase or decrease the position as necessary.

Use case #4: Derivative replacement

Buyer: A large asset manager looks beyond CDX to ETFs in order to express a view on the corporate credit market

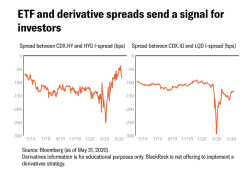

Background: Asset managers have many choices for adding or hedging credit risk in portfolios. Investment grade and high yield fund managers can choose among credit default index swaps (CDX), credit index futures, credit index total return swaps, credit ETFs or individual bonds.

Challenge: The relative merits of using one investment versus another are driven by market dynamics. The liquidity provided by CDX allows investors to rapidly add and reduce risk at scale. However, the basis risk in CDX can be substantial and correlations with cash bond portfolios can deteriorate sharply during times of stress. Credit index total return swaps (such as iBoxx TRS) typically are an improvement in basis risk and correlation, but they do not yet enjoy the same liquidity and transaction cost advantages of CDX or credit ETFs. Corporate bond index futures (e.g., CBOE HYG index futures) are still in a nascent stage.

Fixed income ETF approach: In March, the asset manager that typically used CDX to access investment grade and high yield credit exposure found that the performance differential between the synthetic exposure and individual bonds reached an untenable extreme. This manager had not previously used fixed income ETFs, but had taken note of their deep liquidity and value relative to CDX in the context of the market dislocation. Accordingly, this manager purchased $1.2 billion in LQD and $500 million of HYG to increase exposure to credit amid severe spread widening.