“I would like to see managers value people, and the infrastructure needed for people to do their jobs, above cost,” an asset owner told interviewers conducting a recent EY global survey on alternative investing.3

The sentiment expressed by that investor is indicative of a larger aspect of the state of play in alternative investments – specifically, investors and managers have different priorities and view their relationships through different lenses. Of course, both want their investments to perform like gangbusters, but how they get there matters, too.

Wanted: Improved reporting

In the same EY survey, 40% of investors indicated that improved reporting is among the top three things they’d like their managers to focus on; enhancing middle- and back-office technology is on the top-three wish list of 13% of investors. In other words, they’d like to see their managers invest in the “infrastructure” mentioned by the investor in the EY survey.

Improved reporting has been on the minds of investors for some time now. In a 2017 SEI/Preqin survey of LPs4, only 12% of investors said reporting frequency was unimportant to their firm when evaluating funds and fund managers. At the time of that survey, less than 40% of investors said they’d seen an improvement in reporting frequency during the preceding three years. (It should be noted that the current crisis has brought out the best in GPs as communicators, according to Private Funds CFO, which recently reported that “GP communication has often been a point of dissatisfaction among LPs, who generally want more, specific and easily digestible data from their managers. But in the current downturn, LPs have reported frequent and broad communication from GPs…” The question is, will the new found love of communication extend to reporting post-crisis?)

Customization in demand

Everyone loves customization – institutional investors, included. Alternative investment firms are being challenged by investors to be original and create solutions that aren’t off the shelf boxed offerings.

- Nearly half of institutional asset owners invest in funds with customized fees and liquidity terms.

- More than a third invest in funds with customized portfolio exposures and funds with customized transparency and reporting.5

More recently, a Deutsche Bank survey just prior to the Covid-19 downturn indicated that nearly a third of institutional investors now have customized mandates, which on average account for approximately 9% of their total assets.6

With customization and diversification in demand, managers are taking a second and third look at their product offerings to see where there is room for innovation. Customization of investment strategies, fund structures, and investor communications should all be anticipated. To achieve what investors want in customization, managers will also have to reassess their operational and technological infrastructure to establish if and how they can accommodate the launch of innovative products, entry into new markets, and/or the provisions of further detailed and more timely reports. After all, operations and infrastructure should be viewed as catalysts for growth, not roadblocks.

Lessening the hassle of onboarding

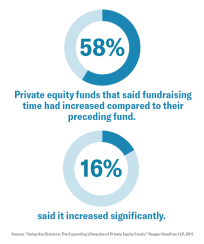

A few years ago, research found 58% of private equity funds said fundraising time had increased compared to their preceding fund – and 16% said it increased significantly.7 No doubt part of that time was spent on LPs filling out non-standard subscription forms, which are typically dense paper documents that leave plenty of room for errors and omissions and require time intensive review.

“In the alternatives industry, there is no standardized subscription documentation for alternative investment funds,” says Joe Henkel, currently Ireland country head and one-time Director of Global Solutions at SEI, one of the world’s leading providers of technology-driven wealth and investment management solutions. “Each private fund has unique qualities, and a law firm will create subscription documents and investor packs that can run to 40 pages or more. They differ between each law firm, fund product and jurisdiction – it is quite a fragmented industry from that perspective. Given that the first impression many LPs get is this inelegant sub doc process, it’s not surprising that investor reporting is equally non-standard and often unsophisticated.”

In short, no investor will ever say they love filling out subscription forms – they want to invest their money! Investors want simplified onboarding processes that take less time. In turn, managers might find easier onboarding shortens the time necessary to raise funds, which can in turn enable them to make speedier portfolio investments.

Transform your organization by learning more about how to improve the investor experience.