The onset of the COVID-19 pandemic triggered unusual disruption across fixed income markets and led to an uptick in activity for fixed income ETFs. During multiple periods of market stress over the past decade, the transparency, access, liquidity, and efficiency of on-exchange trading had already proven valuable to fixed income investors. Despite a solid track record, certain market participants theorized about what might happen should fixed income ETFs be tested by an unprecedented market shock such as that triggered by the pandemic. Questions persisted about whether ETFs would be able to withstand the pressure of continuous selling, and whether they might exacerbate price declines in the underlying markets.

When the shock came, the results were clear: Fixed income ETFs not only held up under stress, but they became important tools for market participants. Institutions turned to the most liquid fixed income ETFs as sources of real-time price discovery and cost-efficient execution when transparent quotations and liquidity had sharply deteriorated in individual bonds.

Volatility followed by surge in fixed income ETF trading

Investors have tended to increase their use of fixed income ETFs during times of uncertainty because they have shown to be efficient and effective tools for rebalancing holdings, hedging portfolios, and managing risk. In fact, during the immediate COVID-19 financial crisis trading in U.S. fixed income ETFs surged to $1.3 trillion in the first quarter of 2020 – half of the $2.6 trillion for all of 2019.

During volatility jumps, investors want to weigh all their options and have maximum flexibility. Practically speaking, that means they need liquidity, and U.S. corporate fixed income ETFs demonstrated they could provide incremental liquidity to the market as trading rose at a faster rate than trading in individual bonds as credit risk spiked.

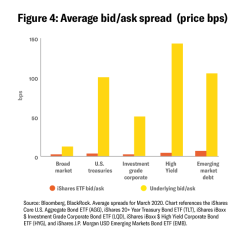

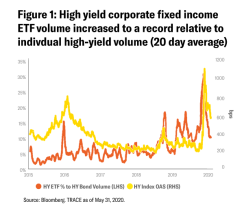

Trading volume in all U.S.-listed high yield fixed income ETFs averaged as much as $7.8 billion per day in March 2020 and represented as much as 29% of individual high yield bond trading in the over-the-counter (OTC) market; for comparison, high yield fixed income ETFs averaged around 11% of OTC high yield trading in 2019. The trend was similar in U.S. investment grade corporate bond trading, where fixed income ETFs in March represented as much as 24% of individual investment grade bond trading in the OTC market, compared with 10% in 2019.

In both high yield and investment grade, as markets became more volatile, investors turned to fixed income ETFs.

Fixed income ETFs indicators of real-time, actionable prices

Many fixed income ETFs traded billions of dollars and tens of thousands of times per day on exchange during the peak of 2020’s early-year market volatility. This frequency of trading is orders of magnitude more often than the most heavily traded corporate bonds.

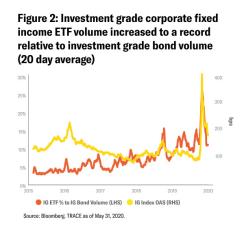

On March 12, one of the worst days for equity markets in modern history and a day during which credit markets sold off sharply, the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) traded almost 90,000 times on exchange compared with just 37 times on average for its largest five bond holdings.

From February through April, the iShares iBoxx $ High Yield Corporate Bond ETF’s (HYG) and LQD’s average daily dollar trading volume was 25 times and 7.5 times more per day, respectively, than their five largest bond holdings.

High trading volumes support the notion that fixed income ETFs provided actionable prices for investors at a time when the underlying bond market was challenged. The on-exchange market prices for fixed income ETFs reflected both absolute and relative values and helped enable investors to understand rapidly changing market conditions.

Because they offer real-time pricing and trade often, fixed income ETFs are central to valuation, portfolio construction and risk management for institutional investors. In particular, fixed income ETFs have emerged as benchmark references for returns, volatility and market sentiment.

More efficient to trade, too

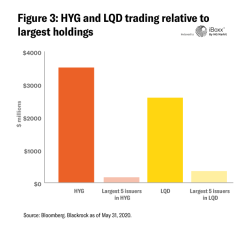

Market volatility creates pricing uncertainty and often translates into wider bid/ask spreads for all securities. Investors who turned to fixed income ETFs during the volatile early months of 2020 found not only real-time, actionable pricing but also lower transaction costs than were generally available in individual bonds.

While bid/ask spreads for fixed income ETFs did increase somewhat during this period of market volatility, they remained lower for iShares flagship fixed income ETFs than for individual bonds and bond portfolios across sectors; from the emerging markets to U.S. Treasuries, bid/ask spreads of the most liquid iShares fixed income ETFs remained lower than corresponding underlying bond portfolios (Figure 4).