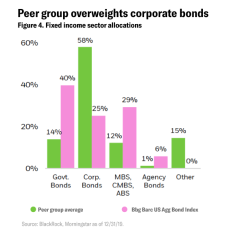

Finding sufficient bond income has become harder, leading portfolio managers to take on more risk by extending duration and reducing credit quality. The average fund in the peer group allocated more than half of its fixed income sleeve/allocation to corporate bonds (see Figure 4, below), a meaningful difference from the aggregate bond benchmark.1 The investment grade and high yield bonds contained within those corporate bond allocations may be of lower quality to achieve income targets, which adds risk to portfolios.

Fixed income factors like quality and value can offer risk diversification and help investors manage downside risk while maintaining similar or higher levels of yield. iShares Investment Grade Bond Factor ETF (IGEB) and iShares High Yield Bond Factor ETF (HYDB) seek to target these two factors in the corporate bond space.

The quality factor screens out bonds with a higher probability of default, tilting a portfolio towards corporate bonds with higher default-adjusted spreads. This lower average probability of default could be accompanied by lower yield. This is why the quality factor is complemented by the value factor, which screens for bonds that are cheap relative to their fundamentals.

The aforementioned iShares ETFs exhibit lower probability of default and similar or higher yield (see Figure 5, below) than their traditional counterparts, helping managers continue to allocate to IG and HY corporate bonds in pursuit of higher income with potentially less risk.

“With factor ETFs, there’s tremendous scope for quality and minimum volatility in equities, and quality and value in fixed income, to help meet income needs with increased diversification and potential for additional protection on the downside.

– Andrew Ang, Head of Factor Investment Strategies, BlackRock

“Factor behavior has helped clients understand how assets are being priced during this period of economic uncertainty caused by COVID. The result is more clients systematically measuring the factor exposures across their equity program to better understand their risk exposures and to re-position the portfolio to express their investment views. The uncertainty caused by the pandemic has made it harder to evaluate company fundamentals, coupled with the high concentration in US equities, has favored technical factors like momentum for much of 2020. However, clients are asking whether pro-cyclical factors like value may strengthen as the 2020 market recovery morphs into an economic recovery.”

– Mark Carver, Managing Director, Global Head of Equity Factors, MSCI

1Benchmark is the Bloomberg Barclays US Aggregate Bond Index.